Renting vs. Buying in Your Market

Renting vs. Buying in Your Market

Deciding whether to rent or buy a home is a significant financial decision that depends on various factors, including your personal circumstances, market conditions, and long-term goals. Here are some key points to consider when weighing the pros and cons of renting versus buying in your market:

Pros of Renting

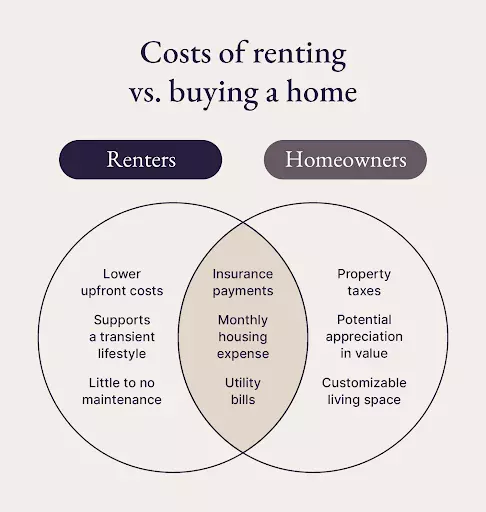

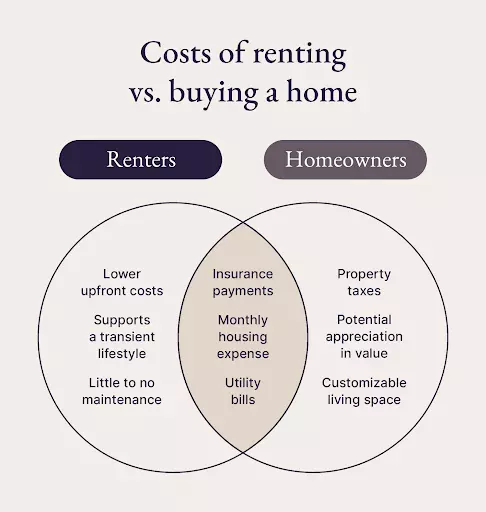

- Lower Upfront Costs: Renting typically requires a security deposit and the first month's rent, whereas buying a home involves a substantial down payment, closing costs, and other expenses.

- Flexibility: Renting offers more flexibility, especially if you anticipate moving within a few years. You can easily relocate at the end of your lease without the hassle of selling a property.

- Predictable Monthly Expenses: Rent payments are usually fixed for the lease term, making it easier to budget and plan financially.

- No Maintenance Costs: As a renter, you are not responsible for maintenance and repair costs, which can be significant for homeowners.

- No Property Taxes or Homeowners Insurance: Renters do not have to pay property taxes or homeowners insurance, which can be a considerable expense for homeowners.

Cons of Renting

- No Equity Building: Rent payments do not contribute to building equity in a property, meaning you do not benefit from any potential appreciation in property value.

- Limited Control: Renters have limited control over their living space, including restrictions on painting, remodeling, and other personalizations.

- Potential Rent Increases: Rent can increase over time, and you may face the possibility of having to move if the landlord decides to sell the property or increase the rent significantly.

Pros of Buying

- Equity Building: Homeownership allows you to build equity over time as you pay down your mortgage and potentially benefit from property value appreciation.

- Stability: Owning a home provides a sense of stability and permanence, which can be beneficial for families and long-term residents.

- Tax Benefits: Homeowners can take advantage of tax deductions for mortgage interest and property taxes, which can reduce their overall tax burden.

- Customization: Homeowners have the freedom to customize and renovate their property to suit their preferences and needs.

- Potential for Rental Income: If you purchase a property with extra units or decide to rent out a portion of your home, you can generate rental income.

Cons of Buying

- Higher Upfront Costs: Buying a home requires a significant down payment, closing costs, and ongoing expenses such as property taxes, homeowners insurance, and maintenance costs.

- Less Flexibility: Selling a home can be a lengthy and costly process, making it less flexible if you need to move quickly.

- Maintenance Responsibilities: Homeowners are responsible for all maintenance and repair costs, which can be unpredictable and expensive.

- Market Risk: Property values can fluctuate, and there is no guarantee that your home will appreciate in value over time.

Factors to Consider

- Financial Stability: Assess your financial situation, including your savings, income stability, and ability to handle unexpected expenses.

- Market Conditions: Research the current real estate market in your area, including property prices, rental rates, and market trends.

- Long-Term Goals: Consider your long-term plans, such as how long you intend to stay in the area and your future financial goals.

- Lifestyle Preferences: Think about your lifestyle preferences, including the desire for stability, flexibility, and control over your living space.

Conclusion

The decision to rent or buy a home is highly personal and depends on your individual circumstances and priorities. By carefully evaluating the pros and cons of each option and considering your financial situation, market conditions, and long-term goals, you can make an informed decision that aligns with your needs and aspirations. Whether you choose to rent or buy, it's essential to weigh the benefits and drawbacks to ensure you make the best choice for your situation.

Categories

Recent Posts

Leave a reply