Condo Buying Tips for DMV Homebuyers: What You Need to Know

Condo Buying Tips for DMV Homebuyers: What You Need to Know

The Washington, D.C., Maryland, and Virginia (DMV) area is a prime market for condo buyers. Whether you're a first-time homebuyer, an investor, or looking to downsize, condos offer convenience, amenities, and a great location. However, buying a condo comes with unique considerations compared to single-family homes. Here are some key condo buying tips to help you make a smart purchase in the DMV area.

1. Understand Your Needs and Budget

Before diving into the condo market, define your goals:

- Are you buying a condo as a primary residence, investment property, or second home?

- Do you prefer a high-rise in D.C., a historic building in Old Town Alexandria, or a modern unit in Bethesda?

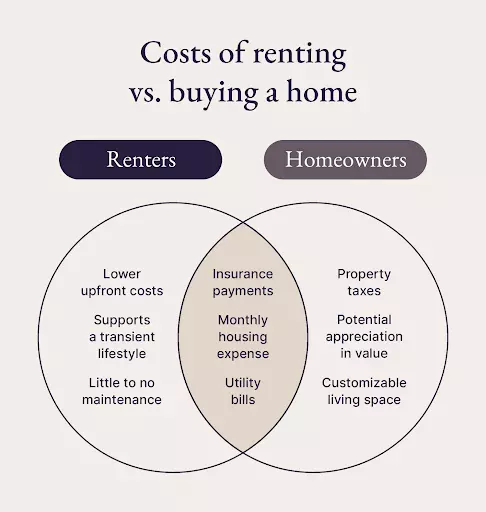

- Determine your budget, factoring in HOA fees, property taxes, and potential assessments.

2. Research the Condo Association and HOA Fees

Every condo is governed by a homeowners association (HOA) that sets rules and collects fees for maintenance and amenities. Before purchasing:

- Review the HOA’s financial health—high reserves indicate a well-managed community.

- Check if the HOA has any pending assessments or litigation.

- Understand the condo’s rules regarding pets, renovations, and leasing.

3. Location Matters—Think Resale and Long-Term Value

In the DMV area, location is key. Consider:

- Proximity to Metro stations, major highways, and public transit.

- Walkability to shops, restaurants, and cultural attractions.

- Future development projects that may impact home values.

- Resale trends in the building and neighborhood.

4. Check the Building’s Condition and Amenities

While amenities like pools, gyms, and concierge services add value, they also increase HOA fees. Assess:

- The overall condition of the building—older buildings may require costly repairs.

- Elevator functionality, lobby condition, and security measures.

- Parking availability (a must-have in many parts of the DMV!).

5. Understand Financing Options for Condos

Not all condos qualify for traditional loans, especially if the building has a high investor-to-owner ratio. Before making an offer:

- Verify if the condo is FHA or VA loan-approved.

- Work with a lender experienced in condo financing.

- Compare mortgage rates and loan terms to find the best option.

6. Hire an Experienced DMV Realtor

Navigating the condo market requires local expertise. A seasoned Realtor can:

- Provide insights on the best buildings and neighborhoods.

- Negotiate the best price and terms on your behalf.

- Review condo documents to ensure there are no red flags.

7. Don’t Skip the Home Inspection

Even in condos, inspections are crucial. Have a professional check for:

- Plumbing, electrical, and HVAC issues.

- Water damage, mold, or structural concerns.

- Noise levels from neighbors or outside traffic.

Final Thoughts

Buying a condo in the DMV area can be a great investment, but doing your due diligence is key. By understanding your needs, researching the HOA, and working with a knowledgeable Realtor, you can find the perfect condo that fits your lifestyle and budget.

Need expert guidance in your condo search? Contact me today to start your journey to homeownership in the DMV!

Categories

Recent Posts

Leave a reply